Figure's IPO: The Long Road to Beating a 2021 Valuation

Next up on the IPO block is Figure. Figure is a fintech company that uses blockchain technology to streamline the financial services industry, primarily focusing on lending. The company aims to make the loan process faster, more efficient, and less expensive for both consumers and institutions.

Let’s take a look to see how the returns are for investors and employees. Please note that we will be using a potential opening day IPO price of $21 for this analysis. The range listed on news articles is $20-$22. Most employees/investors will have a 6-month lockup period, so their actual returns may vary depending on how the market views the company. These are certainly only preliminary numbers, as we’ve learned from Circle and Coreweave, a lot can happen in the lockup period.

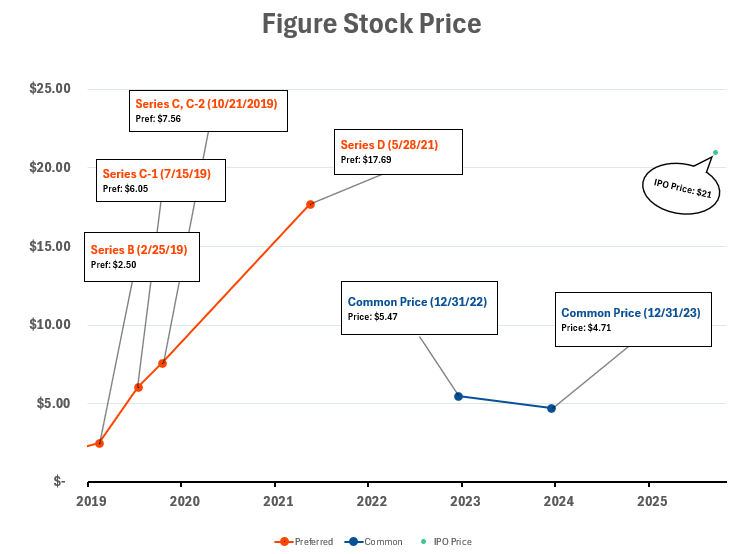

Below is a graph of Figure’s preferred and common stock pricing over time taken from the S1 they filed. Please note the S1 only contained two data points for the common stock, which is why our blue line is incomplete.

Series Seed (20x), Series A (16.5x),investors all did great. Early-stage investors take on a lot more risk, but get much higher returns as shown here.

Series B (8.4x), got a great return, 8.4x handedly beats the S&P which had a 2.34x return in the same time period.

Series C-1 (3.47x), C, C-2 (2.78x) is where it starts to get interesting. These returns may not be as high as what you would typically expect for a 6-year-old hold on an IPO company, but they still beat the S&P by a good clip which returned a 2.15x and a 2.16x over the same time period as the C-1 and C, C-2.

Series D (1.19x), these investors probably aren’t pumped about this one, but at least they are still getting some type of return. They did lose out handedly to the S&P, which beat them with a 1.54x.

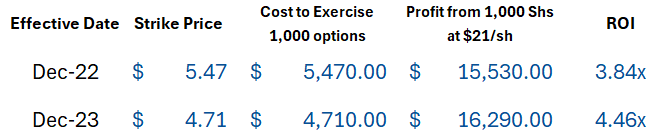

Employees time! Below are listed the two strike prices (the price employees pay to exercise their options) we could find at certain dates according to the S1. This also includes the cost to exercise 1,000 shares, and what those shares are worth today. All exercise costs assume $0 in taxes, which is unfortunately rarely the case, but this allows us to compare these gross amounts apples to apples - as if they are being exercised and sold today. Typically, there will be either short or long-term capital gains associated with the sale (on top of AMT or income tax at the time of exercise).

As usual, the employee discounts here were amazing. Both strike prices, which were set years after the Series C-1 funding round, were priced at a lower value. We can probably assume that those who started earlier got an even better discount.

Another interesting note here is that the employee price actually went down, this isn’t typical for strong startup companies and shows Figure may have gone through a bit of a rough patch at one point. This also may have been a foreshadowing signal to their IPO not being an incredibly strong one.

Lastly, we are unsure if there was the ability for employees to sell at the Series D price when it was raised. If this was the case, employees may have been able to lock in gains fairly close to the IPO price, but four years earlier.

1. The venture capital returns on this IPO were modest. While early investors from Series B and before saw returns greater than 8x, the mid stage investors in Series C, C-1, and C-2 will likely be content, but are not seeing the outsized returns typically expected from a successful IPO. And of course, the Series D investors are only getting a bit more than their money back.

2. Once again, Employee pricing rules. It’s incredible that employees who started in 2023, still received a lower price than investors who put money in almost 4 years earlier.

3. 2020 and 2021 vintage years are going to be tough for VC funds. As with other IPOs this year, we have more late-stage investors who are essentially just getting returned a bit more than the capital they invested. IPOs are typically the big winners for venture firms, but that doesn’t seem to be a certainty for those who invested in the early 2020s.

Written by Sam Stroud, Investor at ESO Fund

Yes, both the data points that were in the S1 had the employees making a very nice return.

Most employees must wait 6 months after the IPO to sell due to a lockup period.

Yes, ESO Fund does offer IPO Lockup Loans to cover the cost of exercise during your lockup period.

Equity decisions are complex, but you don’t have to navigate them alone. ESO Fund has been helping employees unlock the value of their hard-earned equity for over a decade. Whether you’re exercising, planning for taxes, or looking for liquidity, we’re here to provide clear, non-recourse funding solutions tailored to your situation.

📘 Overview of How We Work

See our 3-step process.

⏰ Option Exercise Funding

Exercise without risking savings.

⭐ Client Reviews

Hear from employees we’ve helped succeed.

🚀 Share Liquidity

Unlock cash while keeping your shares.

📊 AMT Calculator

Estimate tax exposure in minutes.

🤝 RSU Liquidity

Access liquidity from vested RSUs before IPO.

Ready to explore your equity options? Our team is here to walk you through the next steps.

Schedule a Call

This innovative service promotes and enables a healthier relationship between companies and employees. I my opinion it's valuable to employees and great for the overall tech environment and economy. It is good for nobody when employees feel trapped because they can't afford to leave. In less extreme cases exercising can be expensive and somewhat risky and this is simply a good smart hedge and a good square deal. Brilliant!