Instantly estimate Alternative Minimum Tax (AMT) on ISO stock options. No Sign-Up, No Download.

• When AMT > Regular Tax ➔ You owe AMT

• When AMT ≤ Regular Tax ➔ No additional taxes owed

A startup employee exercises 10,000 ISOs at a $1 strike price while the 409A value is $6.

• Taxable spread: ($6 – $1) × 10,000 = $50,000

• The employee's regular tax may be unchanged, but their tentative AMT increases based on this $50,000.

If their total income is $180,000, they may owe $4,000–$6,000 in AMT, depending on deductions and exemptions.

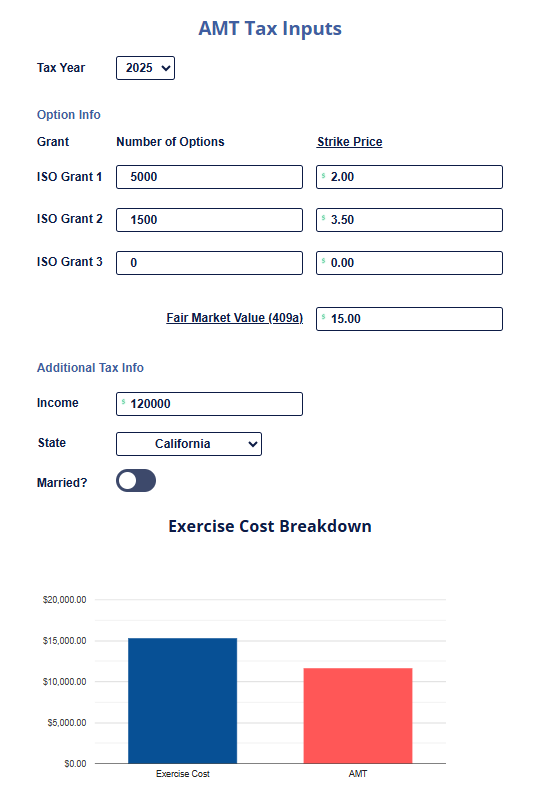

• Shares Exercised – Number of ISOs you exercised this tax year

• Strike Price – The price you paid per share

• 409A Value (Fair Market Value) – Per-share value on the date of exercise

• Filing Status – Single, Married Filing Jointly, etc.

• Estimated Income – Your total taxable income for the year

1. Begins with Total Income

2. Subtracts the Standard Deduction

3. Calculates Regular Federal Income Tax based on the value from #2 and your state/filing status

4. Calculates ISO Spread from the number of options, strike price, and FMV

5. Adds ISO Spread to Total Income to arrive at Alternative Minimum Tax Income (AMTI)

6. Subtracts AMT Exemption ($88,100 for individuals in 2025)

7. Calculates AMT based on #6 and your state/filing status

8. If AMT (#7) is greater than Regular Federal Income Tax (#3) then AMT Owed = AMT-Regular Income Tax. If not, you may not owe any AMT!

• Built for ISO holders at venture-backed startups

• Estimates AMT impact using 409A FMV vs strike price

• No login or email required

• Updated for the 2025 tax year

1. Talk to a tax advisor: This calculator is a great starting point, but a professional can help you map out your full tax picture: especially if you’re thinking about exercising a large number of options. Alternately, TurboTax is fully capable of handling AMT from an ISO exercise.

2. Consider exercising in smaller chunks: Exercising some options now (instead of all at once) can help spread out your tax impact across multiple years and possibly avoid AMT altogether. Check out our page on exercising just enough ISOs to avoid AMT.

3. Explore non-recourse funding: If exercising is too expensive, or too risky, firms like ESO Fund can help cover the cost without you paying out of pocket. We take on the risk so you don’t have to.

The Alternative Minimum Tax (AMT) is a separate tax system created in 1969 to ensure that high-income individuals, especially those benefitting from large deductions or preferential tax treatments, still pay a minimum level of tax (See IRS Topic no. 566).

For startup employees, AMT often comes into play when exercising Incentive Stock Options (ISOs), which are a preferential tax treatment. Even if you don’t sell your shares, the IRS may treat the spread, or the phantom gain between your strike price and the company’s 409A Fair Market Value, as income. This can trigger AMT and lead to a substantial tax obligation, which is why it’s important to run the numbers before you exercise.

Sources: IRS Topic no. 566 - IRS 2026 inflation adjustments

Written by Jordan Long, Marketing Lead at ESO Fund

To calculate AMT, you start with your regular taxable income, then add the ISO spread (the difference between fair market value and strike price at exercise). After subtracting the AMT exemption for your filing status, the result is taxed at 26% or 28%. If this amount is higher than your regular tax, you pay the difference as AMT.

Federal AMT is taxed at either 26% or 28% depending on your income and filing status. In 2026, single filers with income less than $90,100 and married filers with income below $140,200 are taxed at the 26% rate and those with higher income are charged at 28% (see NerdWallet for more info).

The 2025 AMT exemption amounts are $90,100 for single filers and $140,200 for married filing jointly (see NerdWallet for more info).

Yes, if fact, AMT only applies to ISOs when they are exercised. However, if you sell your ISOs within the same tax year as your exericse, that is considered a disqualifying disposition and you will simply owe income tax on the sale amount, no AMT. For more on ISOs, check out our page on Incentive Stock Options.

No. This tool is simplified for ISO stock options. The IRS calculator covers all taxpayers and scenarios, but ours is tailored for startup equity planning.

No, NSOs are taxed as ordinary income when exercised. Read more on Non-Qualified Stock Options and Stock Option Taxes.

Big AMT bill shouldn’t block your exercise. ESO Fund provides non-recourse funding to cover your ISO exercise and the AMT: you keep the upside; we take the downside.

• Covers 100% of exercise cost + estimated AMT.

• Non-recourse: no peronsal risk, no monthly payment.

• Repay only at liquidity (M&A or IPO): if value falls, ESO absorbs the loss.

Terms vary by company and grant. The ESO Fund does not provide legal, financial, or tax advice.

This innovative service promotes and enables a healthier relationship between companies and employees. I my opinion it's valuable to employees and great for the overall tech environment and economy. It is good for nobody when employees feel trapped because they can't afford to leave. In less extreme cases exercising can be expensive and somewhat risky and this is simply a good smart hedge and a good square deal. Brilliant!